Federal Tax Calendar 2024 – Your taxable income and filing status determine both the tax rate and bracket that apply to you, outlining the amount you’ll owe on different portions of your income. For both 2023 and 2024, the seven . Additionally, the third instalment of advance tax for the assessment year 2024-25 is also due on this date By marking these dates in our calendars and staying proactive with tax obligations, you .

Federal Tax Calendar 2024

Source : carta.com

When To Expect My Tax Refund? The IRS Tax Refund Calendar 2024

Source : thecollegeinvestor.com

IRS Tax Refund Calendar 2024: Check expected date to get return

Source : ncblpc.org

Tax Due Dates For 2024 (Including Estimated Taxes)

Source : thecollegeinvestor.com

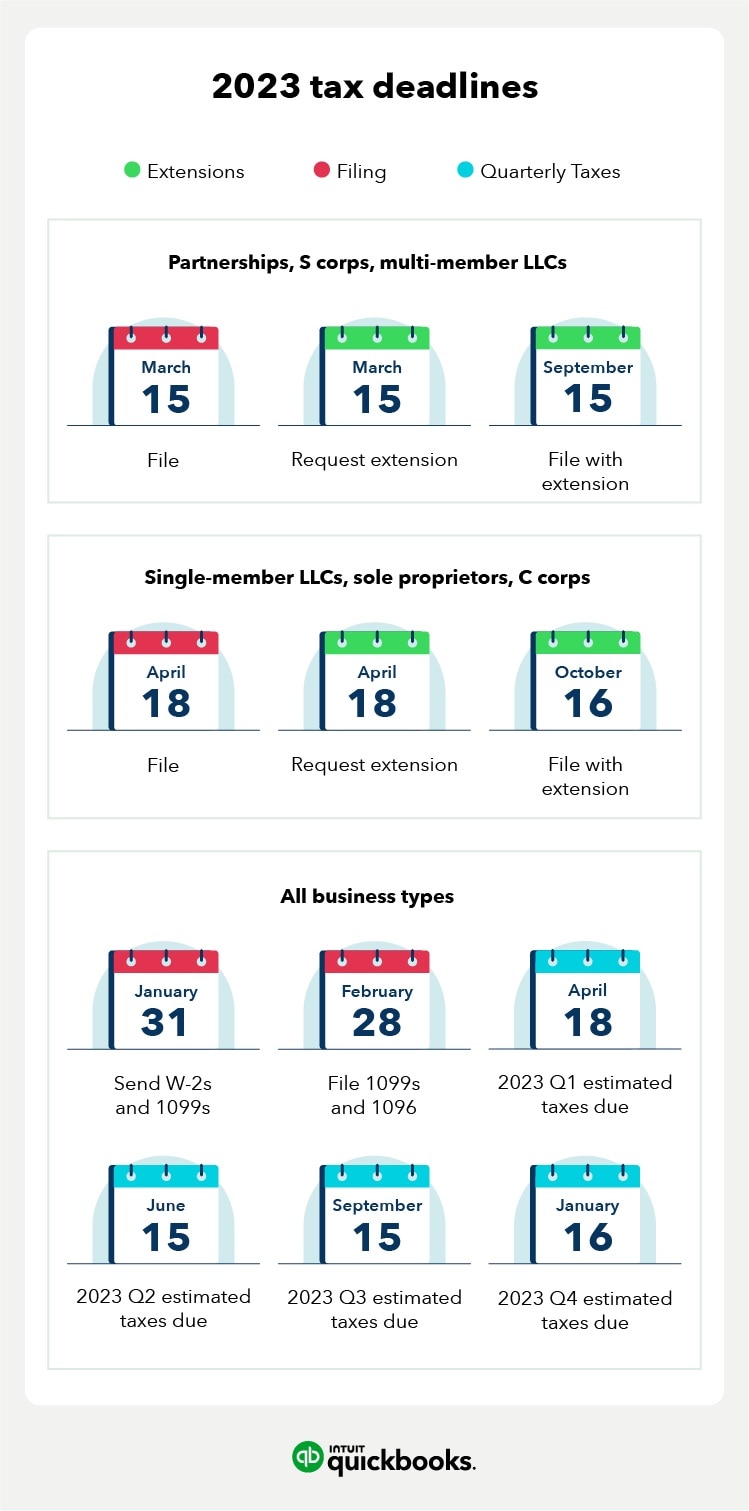

2024 Tax Deadlines for the Self Employed

Source : found.com

What Is the Tax Year? Definition, When It Ends, and Types

Source : www.investopedia.com

Checkpoint Federal Tax Handbook: The Federal Tax Book Trusted by

Source : store.tax.thomsonreuters.com

2024 IRS Tax Refund Calendar Estimate When You Will Get Your Tax

Source : www.cpapracticeadvisor.com

Small business tax preparation checklist 2023

Source : quickbooks.intuit.com

Projected 2024 Income Tax Brackets CPA Practice Advisor

Source : www.cpapracticeadvisor.com

Federal Tax Calendar 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season There are seven federal income tax rates as set by . The due date to file an updated Income Tax Return (ITR-U) for 2021-22 is declared as 31st March 2024. The Income Tax Department of India has tweeted to alert the taxpayers regarding the approaching .

:max_bytes(150000):strip_icc()/taxyear.asp-final-8600d1dae2f845b795b6017fb894f431.jpg)